How to Calculate Common Stock Outstanding From a Balance Sheet The Motley Fool

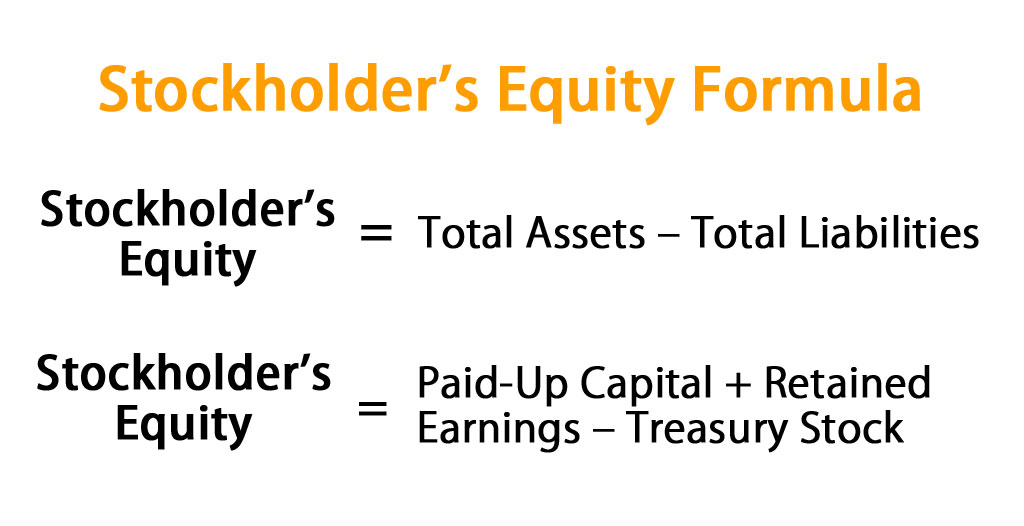

Preferred stock gets its name because it has higher priority than common stock for dividend payments and liquidation payments (sales of company assets in the event of bankruptcy). In other words, those shares are preferred over common shares when there’s a question about who gets paid first. As a result, preferred stock dividends are usually higher and more reliable than common stock dividends. Companies can raise, lower or even stop paying their common stock dividends at will, whereas preferred dividends are generally fixed. The common stock is the number of shares in a company or the number of pieces of ownership. Every company has a balance sheet, which shows the company’s assets, liabilities, and stockholder equity.

- Common stock represents ownership in a company and signifies a claim on part of the company’s assets and earnings.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- Now before knowing further about common stocks, have a look at a balance sheet.

- It is listed under the “Stockholders’ Equity” section and is considered a long-term account.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Here we will discuss how to calculate common stocks, and preferred stocks also play a role in calculating common stocks.

Additional paid-in capital=$16,000

Stock buybacks don’t actually change anything about the company’s operations or financial results. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

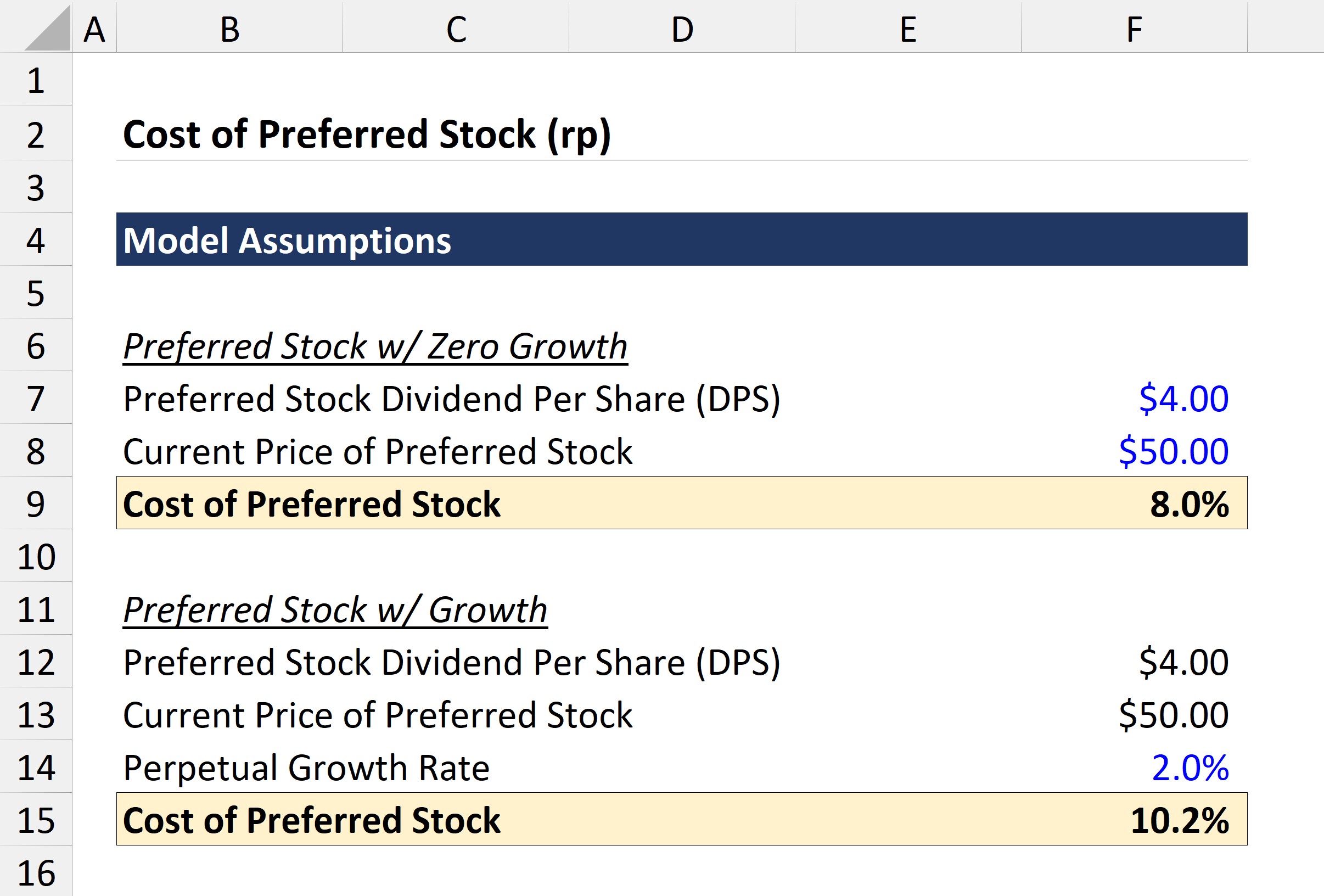

Dividend Discount Models

This ownership typically comes with voting rights, allowing you to have a say in major corporate decisions, such as electing the board of directors or approving mergers and acquisitions. This can give you a sense of involvement and influence over the direction of the company. Historically, common stocks have offered higher returns than asset classes like bonds or savings accounts. If you invest in the right companies, you can benefit from their growth and increase your wealth significantly over the long term. This potential for capital appreciation is one of the main reasons investors turn to common stocks. When investing in stocks, it’s essential to understand the differences between common stocks and preferred stocks.

Ask a Financial Professional Any Question

A corporation’s balance sheet reports its assets, liabilities, and stockholders’ equity. Stockholders’ equity is the difference (or residual) of assets minus liabilities. When a corporation sells some of its authorized shares, the shares are described as issued shares. The number of issued shares is often considerably less than the number of authorized shares. xero bank transfers If an investor owns 1,000 shares and the corporation has issued and has outstanding a total of 100,000 shares, the investor is said to have a 1% ownership interest in the corporation. When an investor gives a corporation money in return for part ownership, the corporation issues a certificate or digital record of ownership interest to the stockholder.

Should a company not have enough money to pay all stockholders dividends, preferred stockholders have priority over common stockholders and get paid first. For holders of cumulative preferred stock, any skipped dividend payments accumulate as “dividends in arrears” and must be paid before dividends are issued to common stockholders. Both common and preferred stockholders can receive dividends from a company. However, preferred stock dividends are specified in advance based on the share’s par or face value and the dividend rate of the stock.

Case Study: Impact of Common Stock Valuation on Market Dynamics

Explore how corporations authorize and calculate issued shares through market cap and balance sheet methods. You can determine a fair value for a stock based on projected future cash flows using DCF analysis. This model also uses WACC as a discount variable to account for the TVM. It accounts for the dividends that a company pays out to shareholders, as the name implies. There are multiple variations of this model, each of which factors in different variables depending on what assumptions you want to include. The GGM has its merits when applied to the analysis of blue-chip companies and broad indices despite its very basic and optimistic assumptions.

The most important votes are taken on issues like the company engaging in a merger or acquisition, whom to elect to the board of directors, or whether to approve stock splits or dividends. One key thing to consider when choosing preferred stock is the dividend. Compare the dividends you’ll receive relative to the share price to determine if the yield offers an attractive return. Issuing common stock is recorded as a credit to the common stock account and a corresponding debit to the cash or other asset account received in exchange for the shares. This reflects an increase in the company’s equity and cash or other asset balances.

As for the “Treasury Stock” line item, the roll-forward calculation consists of one single outflow – the repurchases made in the current period. Earlier, we were provided with the beginning of period balance of $500,000. Here, we’ll assume $25,000 in new equity was raised from issuing 1,000 shares at $25.00 per share, but at a par value of $1.00.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.